Sometimes referred to as identity fraud, identity theft occurs when someone uses your personal information — such as your Social Security Number or driver’s license — to impersonate you. They may take over your open bank accounts, file fake tax returns, attempt to rent or buy properties, or do other kinds of illegal activities in your name. Identity theft is one of today’s many security concerns, both on and offline.

Identity Theft Statistics

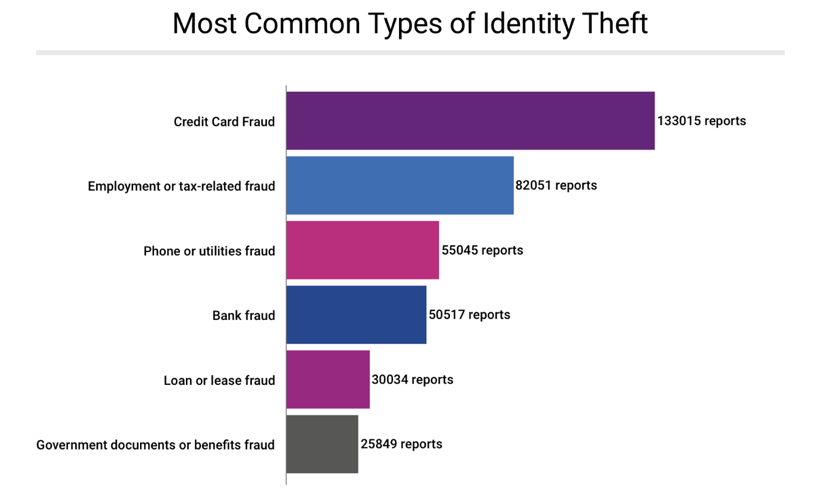

Identity theft is, unfortunately, quite common. Below are some statistics on the most common types of identity theft over the last several years:

- The number of credit card

numbers exposed in 2017 totaled 14.2 million, up

88% over 2016

- Nearly 158 million Social

Security numbers were exposed in 2017, an increase of more

than eight times the number in 2016

- For 85% of identity-theft victims, the

most recent incident involved the misuse or attempted misuse of only one type

of existing account, such as a credit card or bank account

- Children

are often a target of identity thieves, because kids

are unfamiliar with online safety, have Social Security Numbers, and have no

credit history.

Signs of Identity Theft

There are several warning signs you should take notice of that may indicate that someone has stolen your identity. Note that the following things don’t automatically indicate that your identity was stolen, but if one or more of these things happen to you, it’s important to take a minute to make sure everything is alright.

Unfamiliar Charges on Your Card

If you see any charges on your credit or debit card statements that you don’t remember, seem strange or know you didn’t make, it could mean someone has compromised your identity. Don’t brush off unfamiliar charges! Some thieves make small purchases to see if they can get away with it, before moving onto to bigger ones.

Calls from Debt Collectors

If you receive calls or notices from debt collectors, but know that you don’t owe anything, it could mean that an identity thief stole your financial information and is purchasing things in your name without intending to pay for them.

Unfamiliar Bills or Statements

If you’ve been receiving statements for bills you owe or accounts you didn’t open; a thief may have stolen your identity and then opened a credit card or other account in your name.

Missing Email or Mail

If you’re missing important emails or mail, such as your bank statement or credit report, it could mean that a thief has stolen your identity. With the right information, they can change the mailing address on your account. If an identity thief compromises your email account, they can then access all other accounts linked to it. There are online solutions and mobile

applications, like MySudo, that separate your online profiles so that if one is compromised, not all of your accounts are at risk.

How to Prevent Identity Theft

It may seem like identity theft is not a matter of “if” it happens, but “when” — but it isn’t inevitable. You should take the necessary precautions to avoid it.

Safeguard Sensitive Information

Always keep your sensitive information as private as possible. Don’t share your Social Security Number, driver’s license number, PIN number, passwords or any other personal information unless absolutely necessary. If you’re required to provide this information, such as doing a walk-through on an apartment you are interested in, question if they truly need it before giving it out.

Monitor Your Finances

Keep a close eye on all of your finances: your credit card reports, bank statements, and various accounts. If you know the state of your finances, you’ll know when something is wrong.

Use Separate Profiles and Accounts

Do not link up all of your online activity; if you do and one account is compromised, none of your other accounts are safe. MySudo can generate entirely distinct email addresses and

phone numbers, so when you sign up for different services, you’re better protected.

Create Stronger Passwords

Use password best practices at all times — update them regularly, use a unique password for each account, and make your passwords as strong as possible. This will make it more difficult for anyone who might want to infiltrate your various online accounts.

Stay Alert

Be as careful as possible and pay close attention to all of your sensitive information and private accounts. If you know that your data was compromised — perhaps because of a data breach at a store you frequent — be even more alert. Know that despite your best efforts, identity theft still happens, and there are steps you can take to fix the situation if that does happen. The sooner you know there’s a problem, the sooner you can fix it.

In an age of increasingly large and frequent data breaches and compromised personal information, identity theft may feel like an inevitability to some people, even though it doesn’t have to be. Get familiar with products like MySudo to help keep your personal information secure and in the hands of the people it should be in – yours.