Anonyome Labs’ Sudo Platform offers the key building blocks that empower a financial institution to add valuable verifiable credential (often caller reusable credentials) capabilities to existing KYC and identity verification processes. Sudo Platform includes four ready-to-use, and fully brandable products with more in development:

- Mobile DI Wallet: A standalone mobile application for iOS and Android, a user can use the mobile DI wallet for DI interactions and storage: creating and storing cryptographic keys, and creating connections for receiving, holding and presenting verifiable credentials. It interacts with verifiable credential issuers and verifiers and can be used as-is, or branded to match an FI’s existing experiences.

- Mobile DI Wallet SDK: For customers that want to add the DI wallet functionality to their own mobile application, this native mobile SDK provides the capability for storage, creating cryptographic keys, and establishing connections and for receiving, holding and presenting VCs.

- Verifiable Credentials Service/SDK: This service provides the ability to establish connections with DI wallets and to issue VCs. It also provides the ability to request and verify presentation proofs from DI wallets.

- Relay Service/SDK: This service introduces an always-on capability for a mobile DI Wallet. Implemented as a cloud service, the Relay Service provides mediator capability for incoming/outgoing verifiable credential and other messages, so that sending and receiving is not limited to when the client implementations of the mobile DI wallet and SDK are online.

As an API-first developer platform, Sudo Platform includes everything necessary to quickly bring new products to market or augment existing products with value-add privacy and identity protection capabilities. It includes:

- Developer-focused documentation

- APIs

- SDK source code via GitHub

- Sample applications for test-to-deploy of various capabilities

- Brandable white-label apps for quick go-to-market deployments.

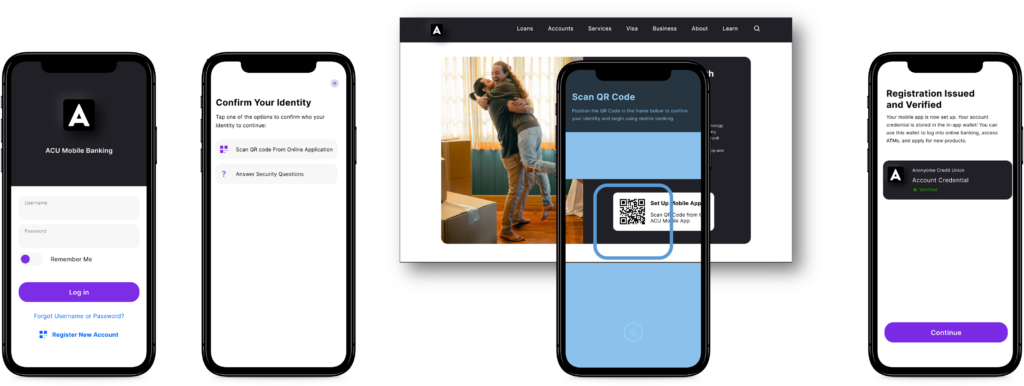

You can see in these images how a credit union has used the Sudo Platform sample app and SDK to build a VCs solution within its banking app:

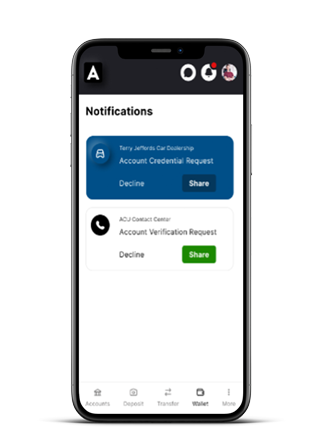

In this example, a customer wants a car loan and the car dealership verifies their account quickly and securely, avoiding additional applications and legacy forms:

In addition to DI solutions, Sudo Platform has modular, turnkey solutions for:

- Safe and private browsing

- Password management

- Virtual private network

- Compartmentalization

- Virtual cards

- Open and encrypted telephony and email communications.

Discover how to quickly take DI to market using Anonyome Labs’ Sudo Platforms APIs.

Get more advice on getting started with DI here or contact us today.